Our Top 30 Forex Brokers Ideas

Table of ContentsThe Facts About Top 30 Forex Brokers UncoveredTop 30 Forex Brokers Can Be Fun For EveryoneSee This Report about Top 30 Forex BrokersThe 30-Second Trick For Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For EveryoneSome Known Details About Top 30 Forex Brokers Not known Facts About Top 30 Forex BrokersSome Of Top 30 Forex Brokers

Like various other instances in which they are utilized, bar charts offer even more price info than line graphes. Each bar graph represents eventually of trading and has the opening cost, highest price, lowest cost, and shutting cost (OHLC) for a profession. A dashboard on the left represents the day's opening price, and a similar one on the right stands for the closing rate.Bar graphes for currency trading aid investors recognize whether it is a customer's or seller's market. The top part of a candle is made use of for the opening cost and highest cost point of a currency, while the reduced portion suggests the closing price and lowest cost point.

The 9-Second Trick For Top 30 Forex Brokers

The formations and forms in candlestick charts are used to determine market direction and motion.

Financial institutions, brokers, and dealerships in the forex markets enable a high quantity of utilize, meaning investors can control big positions with relatively little cash. Utilize in the series of 50:1 is typical in forex, though even greater quantities of utilize are readily available from certain brokers. Nonetheless, take advantage of must be utilized carefully because several inexperienced investors have actually experienced substantial losses using more utilize than was necessary or sensible.

Some Ideas on Top 30 Forex Brokers You Should Know

A currency trader needs to have a big-picture understanding of the economic situations of the different nations and their interconnectedness to grasp the fundamentals that drive currency worths. The decentralized nature of foreign exchange markets suggests it is much less controlled than various other monetary markets. The extent and nature of law in forex markets depend on the trading territory.

Foreign exchange markets are among the most fluid markets on the planet. So, they can be less unstable than other markets, such as property. The volatility of a certain money is a function of numerous variables, such as the politics and economics of its nation. Occasions like economic instability in the type of a payment default or discrepancy in trading relationships with an additional currency can result in significant volatility.

The Best Strategy To Use For Top 30 Forex Brokers

The Financial Conduct Authority (https://www.viki.com/users/top30forexbs/about) (FCA) monitors and manages foreign exchange sell the UK. Money with high liquidity have an all set market and exhibit smooth and predictable rate activity in response to external navigate to these guys occasions. The U.S. dollar is one of the most traded currency worldwide. It is matched up in six of the marketplace's 7 most liquid money sets.

The Best Strategy To Use For Top 30 Forex Brokers

In today's details superhighway the Foreign exchange market is no more solely for the institutional investor. The last one decade have seen an increase in non-institutional investors accessing the Foreign exchange market and the advantages it uses. Trading systems such as Meta, Quotes Meta, Investor have actually been created particularly for the private capitalist and educational product has actually ended up being quicker available.

The Buzz on Top 30 Forex Brokers

International exchange trading (forex trading) is a global market for purchasing and marketing currencies - roboforex. 6 trillion, it is 25 times bigger than all the world's supply markets. As a result, prices change constantly for the currencies that Americans are most likely to utilize.

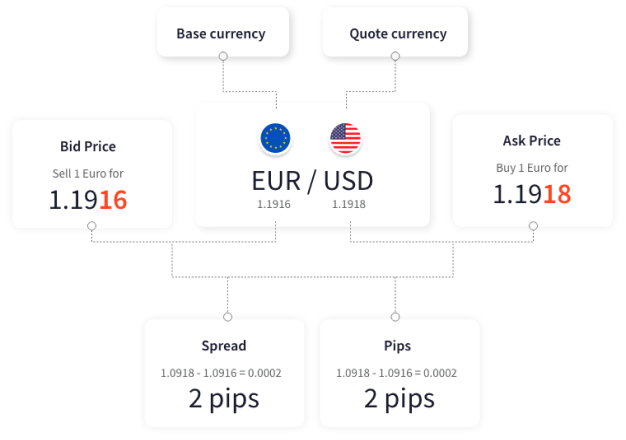

When you sell your money, you get the repayment in a various currency. Every traveler who has actually obtained international currency has done foreign exchange trading. The trader buys a particular currency at the buy price from the market manufacturer and markets a various currency at the marketing cost.

This is the transaction cost to the trader, which consequently is the earnings gained by the market manufacturer. You paid this spread without recognizing it when you exchanged your bucks for foreign currency. You would observe it if you made the transaction, terminated your journey, and then tried to trade the currency back to dollars today.

Our Top 30 Forex Brokers Diaries

You do this when you assume the currency's value will drop in the future. If the money increases in worth, you have to get it from the dealership at that cost.